You are here:Aicha Vitalis > news

Bitcoin Price End of Year 2021: A Comprehensive Analysis

Aicha Vitalis2024-09-21 04:30:20【news】5people have watched

Introductioncrypto,coin,price,block,usd,today trading view,As we approach the end of 2021, it is crucial to reflect on the year's performance of Bitcoin, the w airdrop,dex,cex,markets,trade value chart,buy,As we approach the end of 2021, it is crucial to reflect on the year's performance of Bitcoin, the w

As we approach the end of 2021, it is crucial to reflect on the year's performance of Bitcoin, the world's most prominent cryptocurrency. The Bitcoin price end of year 2021 has been a rollercoaster ride, with significant ups and downs that have captured the attention of investors, enthusiasts, and critics alike. This article aims to provide a comprehensive analysis of the Bitcoin price at the end of 2021, exploring the factors that influenced its trajectory and the potential implications for the future.

At the beginning of 2021, Bitcoin was trading at around $30,000. By the end of the year, the cryptocurrency had surged to an all-time high of nearly $69,000. This represents a remarkable increase of over 130% in just 12 months. The Bitcoin price end of year 2021 has been driven by a combination of factors, including increased institutional interest, regulatory developments, and technological advancements.

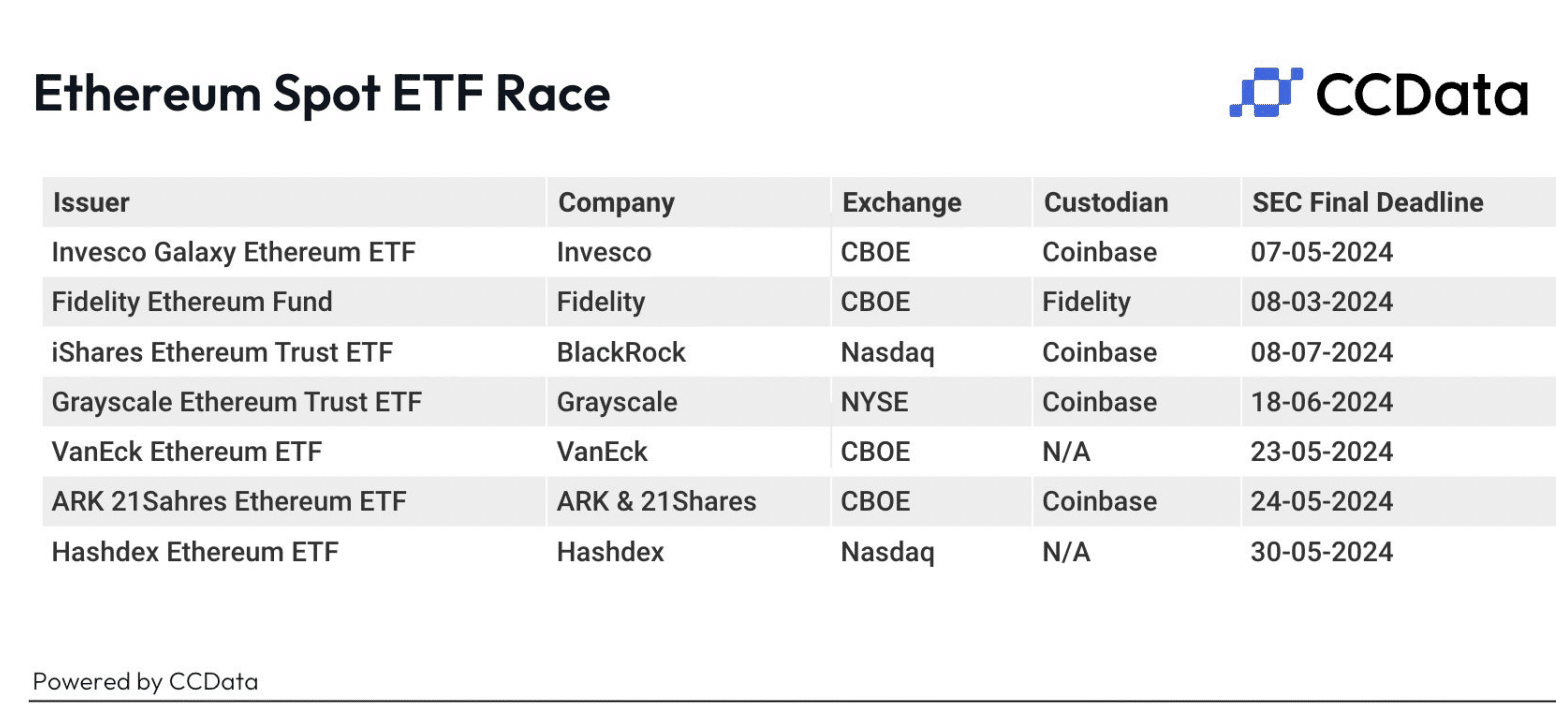

One of the primary factors contributing to the Bitcoin price end of year 2021 was the growing interest from institutional investors. Major financial institutions, such as Fidelity Investments and BlackRock, have started to allocate capital to Bitcoin, recognizing its potential as a digital gold and a hedge against inflation. This influx of institutional money has significantly boosted the demand for Bitcoin, pushing its price higher.

Additionally, regulatory developments have played a crucial role in the Bitcoin price end of year 2021. In November 2021, the Securities and Exchange Commission (SEC) approved the first Bitcoin exchange-traded fund (ETF), marking a significant milestone for the cryptocurrency industry. The approval of the ETF has provided a level of legitimacy to Bitcoin, attracting more investors and further driving its price higher.

Technological advancements have also contributed to the Bitcoin price end of year 2021. The successful completion of the Bitcoin upgrade, known as the Berlin hard fork, in April 2021, improved the network's efficiency and reduced transaction fees. This upgrade has made Bitcoin more attractive to users and investors, further boosting its price.

Despite the impressive growth in the Bitcoin price end of year 2021, there have been concerns about its sustainability. Critics argue that Bitcoin's high energy consumption and finite supply could limit its long-term viability. Moreover, the cryptocurrency market has been prone to volatility, with sharp price fluctuations that can be unsettling for investors.

Looking ahead, the Bitcoin price end of year 2021 has set the stage for an interesting 2022. As institutional investors continue to embrace Bitcoin, its price could potentially reach new heights. However, regulatory scrutiny and technological challenges may also pose risks to its growth.

In conclusion, the Bitcoin price end of year 2021 has been a remarkable journey, with the cryptocurrency reaching new heights and capturing the attention of the global financial community. While the future remains uncertain, the factors that have driven the Bitcoin price end of year 2021 suggest that the cryptocurrency has a promising future. As investors and enthusiasts continue to monitor its trajectory, the Bitcoin price end of year 2021 will undoubtedly be a topic of discussion for years to come.

This article address:https://www.aichavitalis.com/blog/77e95698966.html

Like!(433)

Related Posts

- Bitcoin Encrypt Wallet vs Encrypt Address: A Comprehensive Comparison

- The Rise of RTX 3060 Bitcoin Mining Hashrate: A Game-Changer in Cryptocurrency Mining

- Best Bitcoin Mining Free Electricity: Unveiling the Best Options for Eco-Friendly Crypto Mining

- Title: PHP Get Bitcoin Price: A Comprehensive Guide to Integrating Cryptocurrency Data into Your Website

- Bitcoin Cash Fork Ledger Nano S: A Comprehensive Guide

- Cash App Can't Buy Bitcoin: Understanding the Limitations and Alternatives

- Which Bitcoin Wallet to Use with Backpage

- Binance BSC Network Withdrawal Suspended: What You Need to Know

- How to Convert BTC to ETH on Binance: A Step-by-Step Guide

- Bitcoin Digital Wallet Reviews: A Comprehensive Guide to Secure and Convenient Cryptocurrency Management

Popular

Recent

Binance Withdrawal Reddit: A Comprehensive Guide to Binance Withdrawal Process

What Does It Mean Mining for Bitcoin?

How to Add the Binance Smart Chain to Metamask

The Rise of Smart Chain Avalanche: Binance Labs, Partz, and Cointelegraph Collaborate for a Blockchain Revolution

Can I Buy Bitcoin Cash on Coinbase?

**Exploring the Latest ICO Coins on Binance: A Glimpse into the Future of Cryptocurrency

How to Withdraw Hbar from Binance: A Step-by-Step Guide

Top 10 Bitcoin Wallets 2016: A Comprehensive Guide

links

- Bitcoin Price High in 2017: A Record-Breaking Year for Cryptocurrency

- What is Bitcoin Core and Bitcoin Cash?

- How to Transfer ETH from Binance to Coinbase Wallet: A Step-by-Step Guide

- Can I Buy Bitcoin in Charles Schwab?

- Bitcoin Diamond Highest Price: A Look into the Cryptocurrency's Peak Value

- Binance Coin (BCN) has emerged as a significant player in the cryptocurrency market, particularly within the ecosystem of Binance, one of the largest cryptocurrency exchanges in the world. As the native token of Binance, BCN holds a unique position and offers various benefits to its holders and the broader Binance community.

- Unlocking the Potential of Bitcoin Mining Pool API

- Bitcoin Diamond Highest Price: A Look into the Cryptocurrency's Peak Value

- Buy Bitcoins for My Wallet: A Comprehensive Guide

- Can I Buy Bitcoin Through Etrade?